Summary of Ferd’s financial results for 2019

Ferd’s value-adjusted equity at the close of 2019 has been provisionally calculated to be NOK 35.0 billion (NOK 31.4 billion at 31 December 2018). The return on value-adjusted equity for Ferd as a whole was 12.2%. All Ferd’s business areas generated a return of over 10% in 2019. After adjusting for a dividend paid to Ferd’s owners, the return in NOK terms was 3.8 billion.

The return on Ferd Capital’s combined portfolio was 16.3%. Ferd Capital’s privately-owned investments increased significantly in value in overall terms in 2019 and generated a return of 19.1%. Ferd achieved a return of 17.6% on its real estate portfolio. Good progress at Ferd Real Estate’s residential projects was the main reason for this performance. Ferd External Managers reported an aggregate return of 14.0% (in USD terms) on its four investment mandates, with three of the mandates delivering good results in both absolute and relative terms. Ferd Invest’s portfolio of Nordic listed shares delivered a return of 10.3%, which is a weaker return than that of the benchmark index which it is measured against.

In 2019 Ferd received payments totalling NOK 4.2 billion from investment realisations and dividends. In 2019 we realised our investment in Scatec Solar and received significant dividends from our portfolio of privately owned companies. Ferd invested a total of NOK 2.0 billion in 2019. The largest investments made in 2019 were in Ferd Capital’s listed companies.

In 2020 we have invested in the Marienlyst real estate site and the HR company Simployer. Ferd has purchased NRK’s former headquarters at Marienlyst, a project that we have called Lyst. This will be our largest single investment to date. Ferd will continue to have significant liquidity and investment capacity going forward. At the end of 2019, Ferd’s bank deposits and money market fund investments totalled NOK 3.9 billion, which represented over 11% of value-adjusted equity. The value of Ferd’s listed shares, equity fund investments and liquid hedge fund investments was NOK 8.9 billion, meaning that at 31 December 2019 Ferd’s holdings of cash, cash equivalents and liquid investments totalled NOK 12.8 billion. Ferd also had un-drawn credit facilities totalling NOK 6.9 billion.

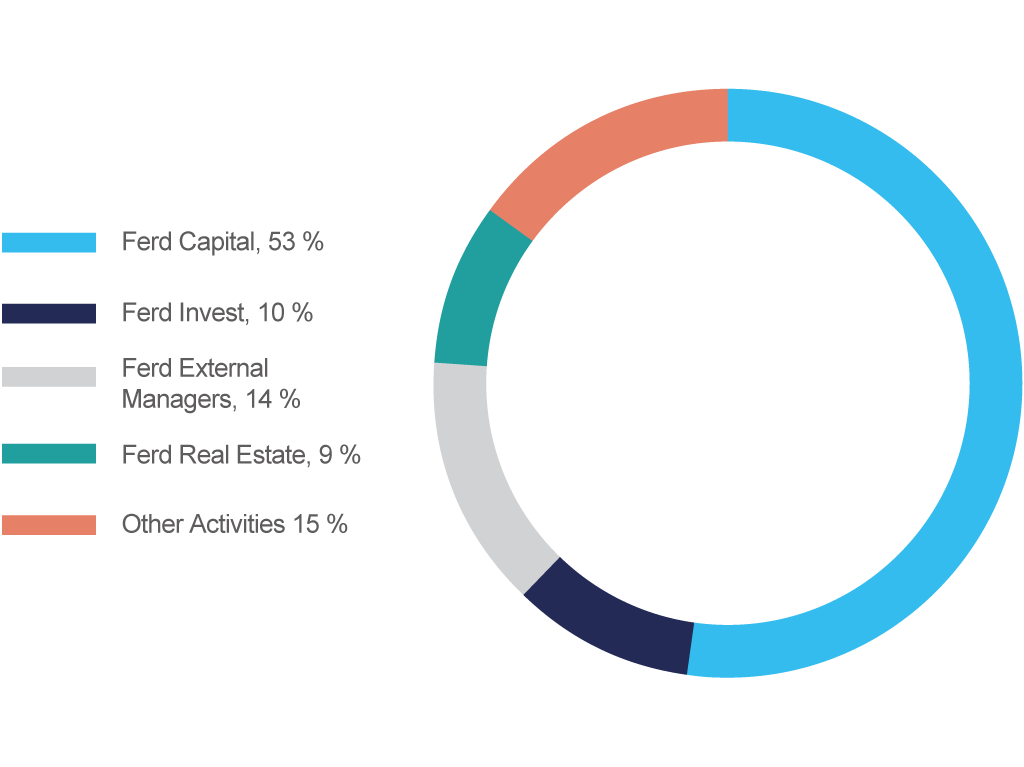

Composition of Ferd’s value-adjusted equity at 31 December 2019:

Ferd Capital

Ferd Capital is a long-term investor that plays an active ownership role in its portfolio companies during Ferd’s ownership period in order to ensure the best possible value creation. The business area has three investment mandates: Private companies, Listed companies and Special Investments. The Ferd Special Investments mandate permits investments in financial instruments relating to most aspects of corporate capital structure, and these investments are not subject to any requirements in respect of ownership interest or influence. Ferd Capital’s privately owned investments at 31 December 2019 were Elopak, Aibel, Interwell, Mestergruppen, Brav, Fjord Line, Mnemonic, Fürst and Servi. Its largest investments in listed companies were Benchmark Holdings and Nilfisk. Its investment in Simployer (previously Infotjenester) was finalised January 2020.

The combined return on Ferd Capital’s portfolios of privately owned and listed companies was 16.3% in 2019. Nearly all the private companies reported stronger earnings in 2019 than in 2018. Elopak and Interwell were the companies that made the biggest contribution to the increase in the value of the portfolio of private companies. The highest return from Ferd Capital’s portfolio of listed investments was from Scatec Solar. The combined value of Ferd Capital’s three portfolios at 31 December 2019 was NOK 18.5 billion.

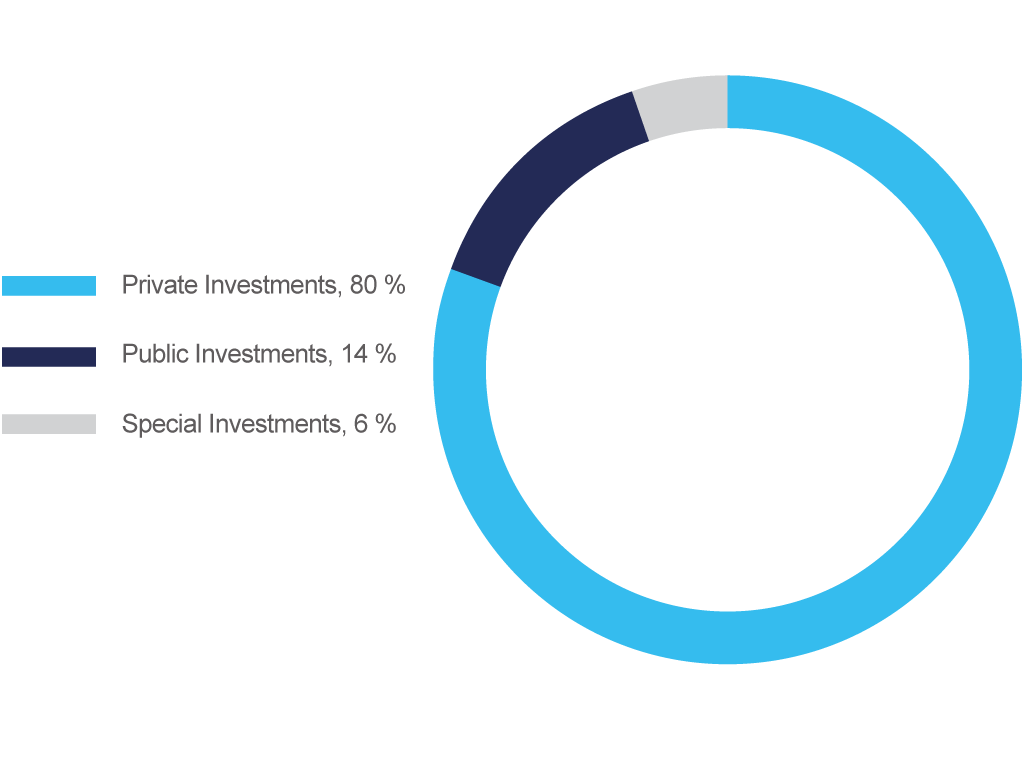

The allocation of Ferd Capital’s investments between the three mandates at 31 December 2019:

Ferd Real Estate

Ferd Real Estate is an active real estate investor. The business area develops residential property, office buildings and warehousing/office combination buildings. Ferd Real Estate carries out projects both independently and in collaboration with selected partners. The business area also carries out purely financial real estate investments. It is also responsible for managing the office premises and warehouse/office combination premises owned by Ferd.

The real estate portfolio generated a return of 17.6%. Residential real estate prices rose by 5.5% in Oslo in 2019, while the yield on commercial real estate decreased marginally. Ferd Real Estate achieved a good return on both its residential investments and its commercial properties. The reasons for the business area’s return include good progress at the majority of individual projects and the increase in the value of Ferd’s properties. Ferd Real Estate’s value adjusted equity was NOK 2.9 billion at 31 December 2019.

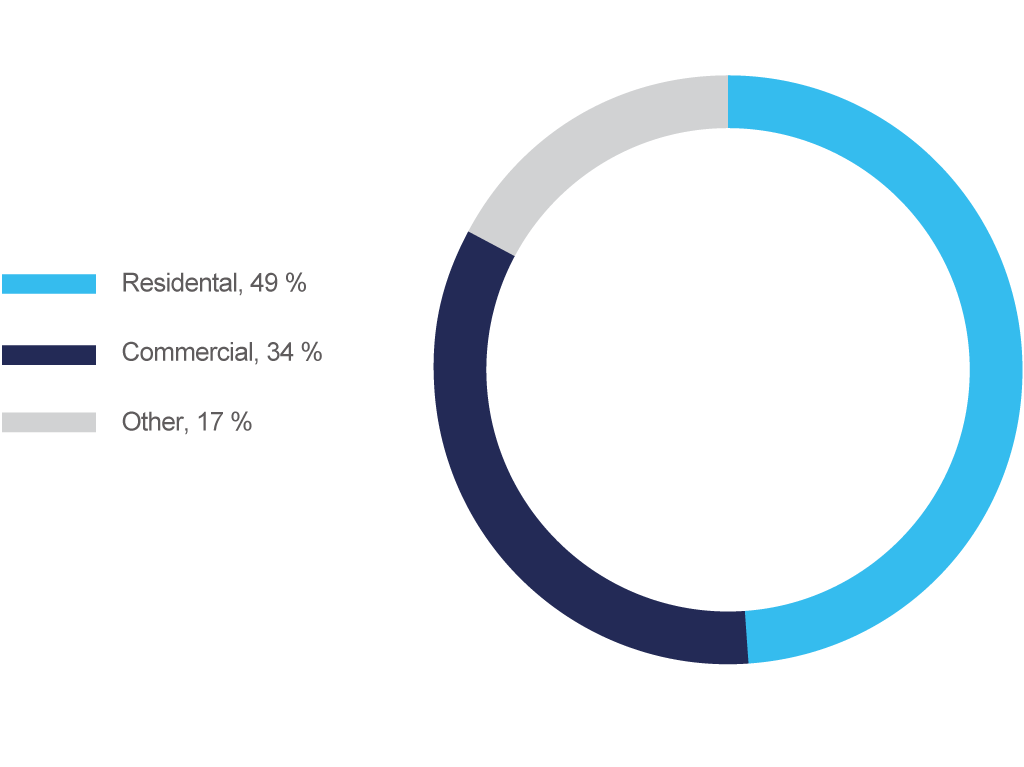

Allocation of Ferd Real Estate’s portfolio by market segment at 31 December 2019:

Ferd Invest

Ferd Invest is a financial investor that invests in listed Nordic companies. Its target is to generate a return that is higher than the return on its Nordic benchmark index. Ferd Invest’s mandate does not stipulate limits with regard to the allocation of investments between countries or sectors. The portfolio is concentrated, which means that significant variation in relative return must be anticipated from time to time.

A new team was appointed for Ferd Invest in 2019 and a new strategy was developed. Going forward Ferd Invest will primarily focus on companies with a larger market capitalisation and will hold equities that are more liquid.

In 2019 the Nordic region’s stock markets rose significantly. Ferd Invest generated a return of 10.3% in 2019.

The largest investments in the portfolio at the close of 2019 were Novo-Nordisk, Lerøy Seafood, Essity, Hexagon and ISS. The value of Ferd Invest’s portfolio at 31 December 2019 was NOK 3.4 billion.

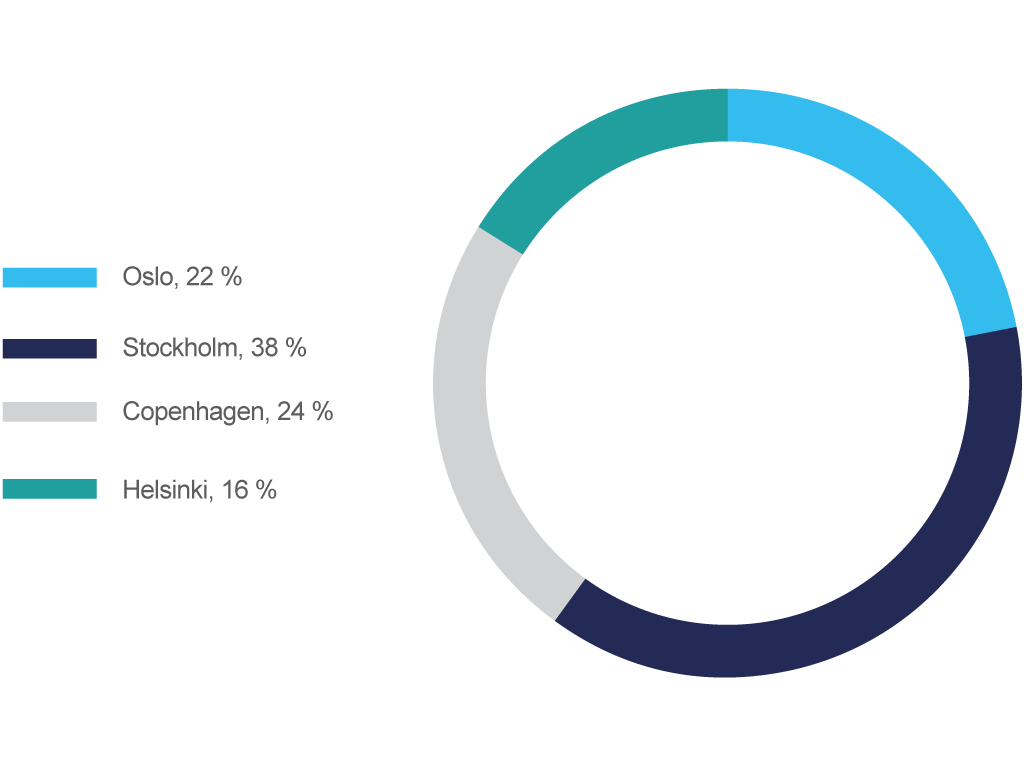

Allocation of Ferd Invest’s portfolio between the Nordic stock exchanges at 31 December 2019:

Ferd External Managers

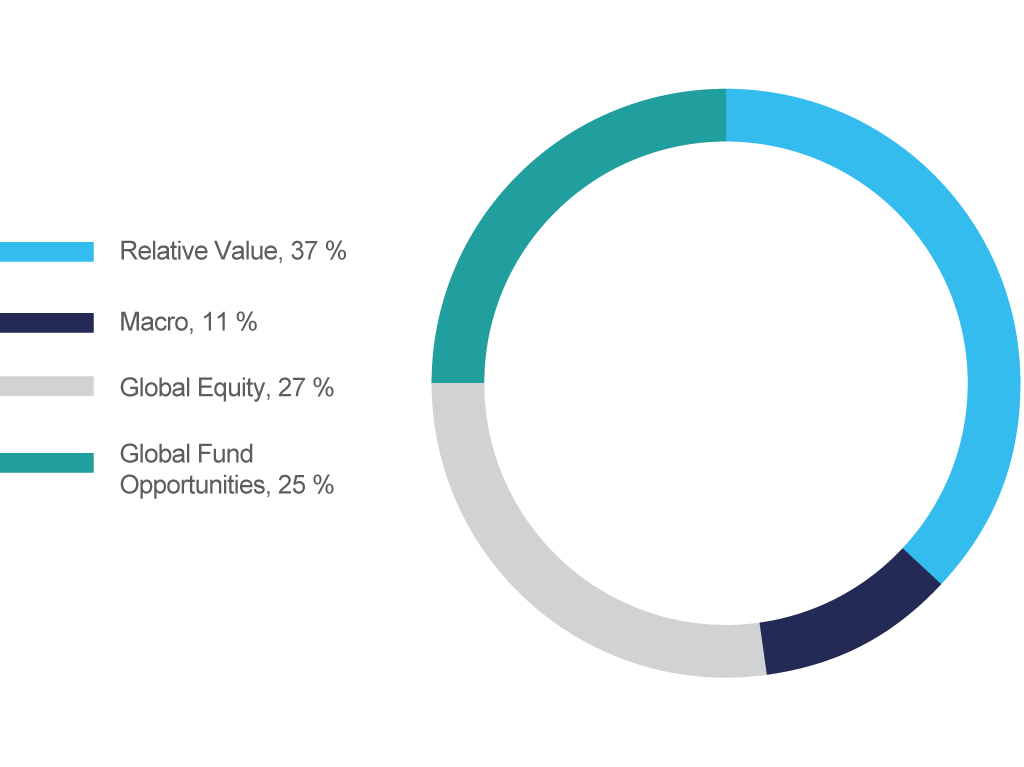

Ferd External Managers has the four investment mandates Relative Value, Macro, Global Equity and Global Fund Opportunities. The investment objective for these portfolios is to generate attractive risk-adjusted returns over time, both in absolute terms and relative to their respective markets and indices.

The portfolios, which are accounted for and managed in US dollars, produced an aggregate return of 14.0% in 2019. The Relative Value and Global Equity portfolios generated a good return compared with their respective markets. The Global Fund opportunities mandate had a very good year and was up 23.2%. All of the funds in the mandate made a positive contribution, and the largest investment in the mandate grew very strongly. The return generated by the Macro mandate was weaker than the benchmark against which it is measured. The market value of the Ferd External Managers portfolio at 31 December 2019 was NOK 4.8 billion.

Allocation of the Ferd External Managers portfolio between investment mandates at 31 December 2019:

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs that deliver measurable social results, and it contributes to the consolidation of their market. FSE provides these companies with networking, expertise and capital in an active partnership with defined milestones and set social targets. FSE looks for social entrepreneurs with a good business model which, in addition to producing an excellent social impact, is also capable of producing a profit over the long term. This is because financial sustainability is the best way of ensuring the scalability of social results.

Norway’s first social impact contact was signed in 2019, specifically by FSE, Trygg av natur and Lier Municipality. A social impact contract involves a private investor financing an activity with a fixed performance target, with the investor reimbursed by the public sector if the target is met. Ferd financed the social impact contract, Trygg av natur is running the project, and Lier Municipality will reimburse Ferd half its investment if the agreed results are achieved.

At the end of 2019, FSE had ten companies in its portfolio and one fund investment. FSE made one equity investment in 2019, namely in Mestringsguiden (a social entrepreneur that helps people with a refugee background), and it increased its ownership interest in Unicus in the autumn. Unicus provides IT system testing services and only employs consultants with an Asperger’s diagnosis.

Other Activities

Other Activities principally comprises bank deposits and money market funds, as well as investments in fund units purchased in the secondary market and investments in externally managed private equity funds.

Ferd received NOK 300 million from these two portfolios in 2019. The Other Activities area also includes central group costs and the financial results of the financial instruments held to manage Ferd’s currency exposure.

Ferd recognised only small foreign exchange differences for 2019 as a whole.